- Home

- Resources

Resources

Let us move you with honesty and greatness.

Resources

Clarity lives here

We believe informed clients make better decisions—and better decisions lead to better outcomes. This is where we share the tools, insights, and answers that help business owners and HR leaders cut through the noise and take confident next steps.

Whether you’re a client, a prospective partner, or someone just trying to make sense of employee benefits, you’re in the right place.

Guides & Explainers

What to Expect at Renewal

Why Strategic Benefits Matter

Benefits aren’t just a budget line. This guide shows how they shape culture, retention, and growth.

How to Know If You’ve Outgrown Your Broker

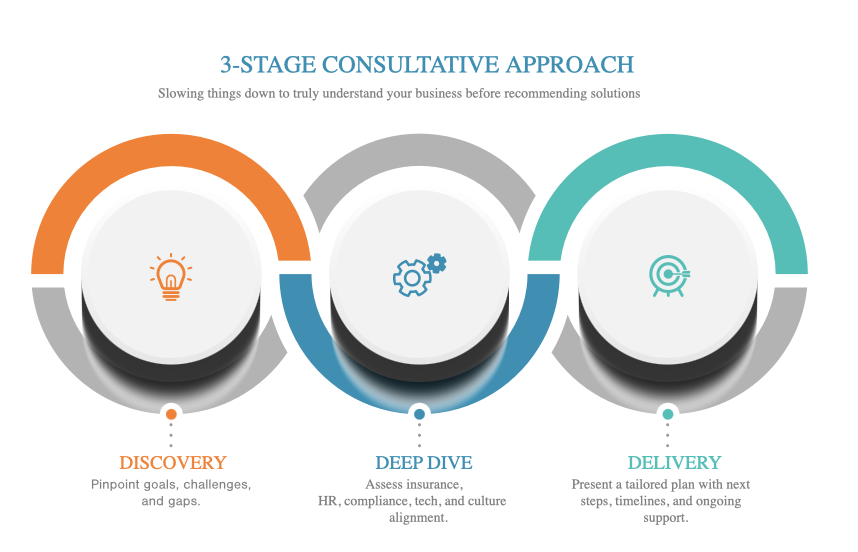

The Raise 3-Stage Process Explained

What Clients Ask Most

Can you work with our payroll provider?

Yes, absolutely! While we don’t integrate directly with every system, we work collaboratively with all payroll systems if not direct integration

The collaborative advantage:

When your broker works hand-in-hand with your payroll provider, you get:

-

Streamlined setup – We coordinate with your payroll team for seamless employee onboarding

-

Accurate deductions – Clear communication ensures proper benefit deductions every cycle

-

Simplified reporting – We provide the benefits data your payroll team needs for compliance

-

Error prevention – Direct collaboration eliminates miscommunications and costly mistakes

-

Better employee experience – Coordinated systems mean faster, smoother benefits administration

The bottom line: Your payroll provider handles the numbers. We handle the strategy. Together, we create a unified approach that reduces your administrative burden.

What’s your process during open enrollment?

Our open enrollment process:

-

8 months prior: Strategic planning and improvement discussions

-

6 months prior: Alignment calls, stewardship disclosures, and needs analysis updates

-

2 months prior: Marketing reports with plan options and decision finalization by 45-day deadline

-

Live enrollment: We manage everything – employee Zoom meetings, educational consulting, form processing, and carrier communications

-

Post-enrollment: Coordinate rate/deduction updates with bookkeeping and complete wrap-up documentation

We handle the entire process so you can focus on running your business.

Do you help educate employees?

Yes, we actively educate employees and provide comprehensive resources so they know exactly where to go and what to do.

Our approach:

-

Upfront education – We equip employees with resources and knowledge before issues arise

-

Direct carrier access – Employees communicate directly with member services at their insurance carriers (you’re paying for that service, so use it!)

-

Best-in-class partners – We select carriers with top customer service ratings

-

Escalation support – When carrier resolution isn’t working, we step in to ensure they deliver on their commitments

Bottom line: We empower employees with knowledge and direct access to carrier support, while serving as your advocate when escalation is needed.

Do you charge fees?

We operate on a transparent hybrid fee model that ensures our recommendations are always in your best interest. Our fees are based on the level of service and solutions we provide to your organization – not on which insurance carrier we place your business with.

Here’s how it works: We determine our fee based on the scope of services you need, whether that’s basic plan placement, comprehensive benefits strategy, ongoing compliance support, or full-service employee communication and enrollment. In many cases, the insurance commissions we receive help offset or fully cover these fees, but the fee amount is set independently of commission levels to avoid conflicts of interest.

This approach means you get objective advice focused on finding the right solutions for your team, while often paying little to no out-of-pocket costs. This approach means you get objective advice focused on finding the right solutions for your team, while often paying little to no out-of-pocket costs. We’re always transparent about commission structures and how they factor into your overall investment, because we believe you deserve to understand exactly how your benefits advisor is compensated.