At Raise Insurance, we don’t lead with quotes—we lead with questions.

Our job isn’t to push plans. It’s to understand your organization, solve real problems, and build a benefits strategy that reflects your values, culture, and growth.

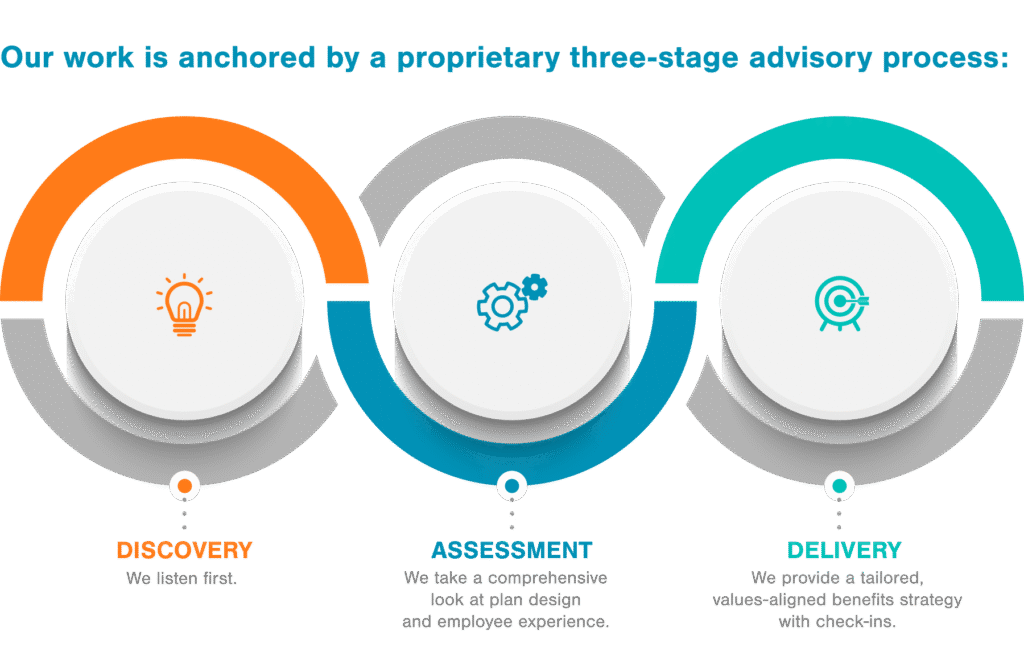

We use a proven three-stage process to guide every engagement. Whether you’re switching brokers or building your first program, our approach creates clarity and long-term results.

The Raise Process

1. Discovery

We begin with a conversation—not a spreadsheet.

We take time to understand what’s working, what’s not, and where you’re feeling friction. We ask about your workforce, your culture, your business goals—not just your budget. This phase surfaces risks, opportunities, and unmet needs across HR, compliance, employee communication, and more.

2. Assessment

3. Custom Planning

Why it matters

Most brokers operate reactively. They show up at renewal, shuffle plan options, and disappear.

Raise is different. We’re strategic, hands-on, and built for the long haul.

- We believe your benefits program should:

Reduce friction—not create more admin work - Align with your values—not just carrier options

- Attract and retain great people—not just check compliance boxes

- Improve over time—not stay on autopilot.

The Difference Raise Makes

Before Raise

-

Last-minute renewals, rushed decisions

-

Confusing plan documents, low employee buy-in

-

Compliance unknowns and audit anxiety

-

Feeling like “just another account”

After Raise

-

Structured timeline, data-driven recommendations

-

Clear education, stronger engagement

-

Proactive support, built-in compliance tools

-

Direct access to Ezra and ongoing guidance